A friend of mine currently living in the US is planning to move and retire in Thailand. What is the best way for him to transfer funds from his US bank to a Thai bank once he is able to open a bank account here? We've thought of several options but are confused about the best method. Any feedback on the choices below would be appreciated and/or any method we haven't thought of.

* Bring the funds in cash. This one seems pretty dangerous as it is a large amount.

* Cashiers Check. Do all Thai banks accept cashiers checks and how long does it take before the funds are available.

* Wire Transfer from His Home Bank to my account. Would this trigger a US Gift tax and isn't this a pretty expensive way to collect the funds?

* Wire Transfer to a yet to be opened Thai bank account. Again, isn't this pretty expensive and will a US bank wire transfer funds when a request is made from outside the country?

* Wise Money Transfer Service. I think he has to wait for a Thai bank account to be opened and then figure out how to fund a Wise account from Thailand.

* Put the funds in My Us bank Account and then Wire Transfer from that account. Once the funds arrive I can retrieve them and reimburse my friend. I have previously established a procedure to transfer money from my US account to my Thai bank, but this is pretty pricey. But, the money arrives rapidly.

Any other option and any feedback on the above choices would be greatly appreciated.

Transfering Money to Thailand

- Gaybutton

- Posts: 21595

- Joined: Sat Jul 31, 2010 11:21 am

- Location: Thailand

- Has thanked: 2 times

- Been thanked: 1322 times

Re: Transfering Money to Thailand

If he brings the funds in cash and the amount is $10,000 or greater, he must first fill out the Ficen form 105, which can be done online - https://fincen.gov/sites/default/files/ ... 5_cmir.pdf

Also, he would have to bring all new bills or the Thai banks won't accept it.

I would think if he wants to transfer the funds from his US bank account, then he should talk to his bank, telling them what he wants to do and get their recommendation for how best to go about it.

Also, he would have to bring all new bills or the Thai banks won't accept it.

I would think if he wants to transfer the funds from his US bank account, then he should talk to his bank, telling them what he wants to do and get their recommendation for how best to go about it.

-

Jun

Re: Transfering Money to Thailand

What do the US banks charge for transfers ? If I use a UK bank, the bank charges a fee, they then make an additional profit on the exchange rate and then the overseas bank charges a fee for receiving foreign currency.

The total charge is over 3%, which is to be avoided. I gather some banks are worse.

Regularly paying 3% charges on all your money is like burning a year's income, assuming people work for 30~40 years to save enough to retire.

Wise is far cheaper and faster than the UK banks. I guess it's the same in the US, which is why other people use them.

From the UK, I can fund Wise either by debit card or direct from my online banking. Presumably the US has similar systems ?

So setting up Wise and online banking would be a good start.

I do know of instances where people have had problems with Wise over the checks they make to prove where the income comes from and then the Wise customer service is automated and difficult to deal with to resolve that problem.

Some of them are using XE, which is owned by Euronet (listed on Nasdaq). Wise is listed on the London Stock Exchange.

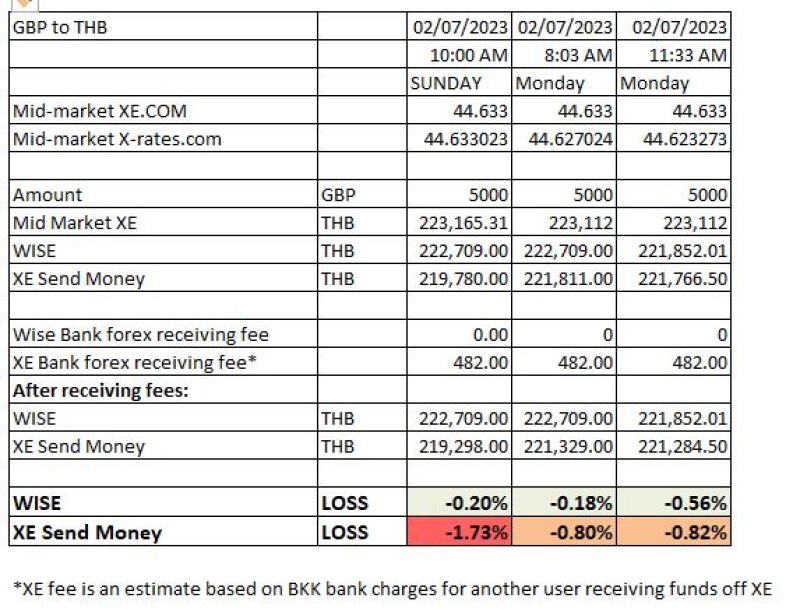

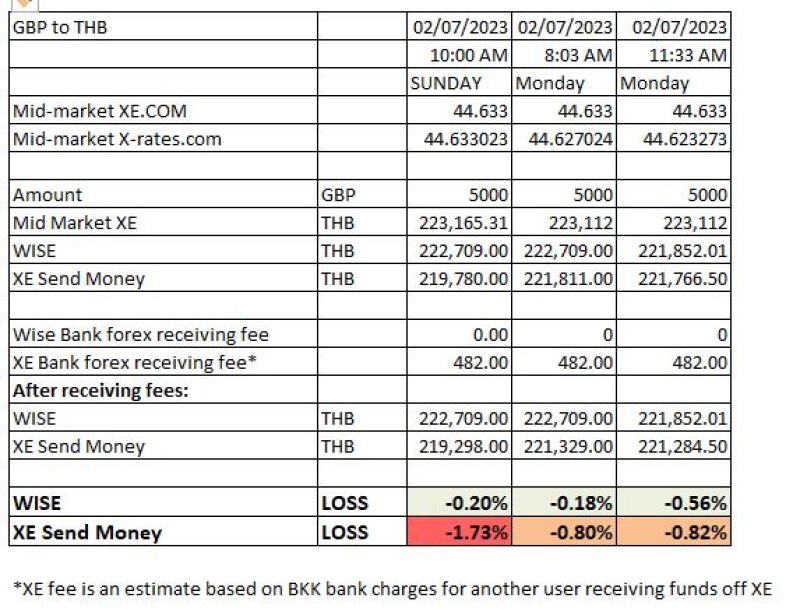

However, I just did a check on a transfer today:

£5000 gets THB 222,709 on Wise, with no charge by the receiving bank

£5000 gets only 219,780 with XE. I don't know if their system incurs an additional charge by the receiving bank. From what I recall, XE gave a far more competitive quote on Friday. (Both quotes under the "Send Money" tab)

Re: Transfering Money to Thailand

Thanks guy's for the quick feedback. Any additional thoughts are more than welcome.

- 2lz2p

- Posts: 967

- Joined: Sun Aug 01, 2010 8:08 am

- Location: Pattaya, Thailand (Jomtien)

- Has thanked: 150 times

- Been thanked: 114 times

Re: Transfering Money to Thailand

I use Wise to transfer funds from my US bank to my Bangkok Bank account - Bangkok Bank records Wise transfers as FTT transactions which denotes it is foreign transfer into the account. To ensure it is so coded, in the reason for transfer drop down menu, click on long term stay in Thailand (currently the last item in the list). Having it coded as such is important if you need to show Thai Immigration the funds came from outside of Thailand.

Although I have Wise draw the funds from my Chase Bank account using the ACH system, the transfer as mentioned can be funded in different ways. One of these is to create "virtual" account with Wise which will have its own ACH bank number and customer account number. You can usually do an ACH bank to bank transfer from your US Bank to fund the "virtual" account.

The funds are held by Wise in the currency you choose (e.g., US$). With this type of Wise account, you can choose to tell Wise when you want it to transfer funds to your Thai bank account, which will be done in Thai baht at whatever exchange rate Wise is using on the date of the actual transfer. Since the funds arrive in Thai baht, there is no conversion charge by the Thai receiving bank.

This "virtual" account is often used by US Social Security recipients as they can have their monthly payment directed the the ACH and account number they have with Wise.

Your friend may want to consider doing this as the funds can be transferred to the "virtual" account before they leave the USA (or if they have online banking, doing so after they arrive). Once they open their Thai bank account, they can then instruct Wise to transfer the funds to that account.

Although I have Wise draw the funds from my Chase Bank account using the ACH system, the transfer as mentioned can be funded in different ways. One of these is to create "virtual" account with Wise which will have its own ACH bank number and customer account number. You can usually do an ACH bank to bank transfer from your US Bank to fund the "virtual" account.

The funds are held by Wise in the currency you choose (e.g., US$). With this type of Wise account, you can choose to tell Wise when you want it to transfer funds to your Thai bank account, which will be done in Thai baht at whatever exchange rate Wise is using on the date of the actual transfer. Since the funds arrive in Thai baht, there is no conversion charge by the Thai receiving bank.

This "virtual" account is often used by US Social Security recipients as they can have their monthly payment directed the the ACH and account number they have with Wise.

Your friend may want to consider doing this as the funds can be transferred to the "virtual" account before they leave the USA (or if they have online banking, doing so after they arrive). Once they open their Thai bank account, they can then instruct Wise to transfer the funds to that account.

-

Jun

Re: Transfering Money to Thailand

Useful to know.2lz2p wrote: ↑Sun Jul 02, 2023 4:25 pm I use Wise to transfer funds from my US bank to my Bangkok Bank account - Bangkok Bank records Wise transfers as FTT transactions which denotes it is foreign transfer into the account. To ensure it is so coded, in the reason for transfer drop down menu, click on long term stay in Thailand (currently the last item in the list). Having it coded as such is important if you need to show Thai Immigration the funds came from outside of Thailand.

If actually keeping money with Wise, you might want to consider if this is covered by government bank deposit insurance.2lz2p wrote: ↑Sun Jul 02, 2023 4:25 pmOne of these is to create "virtual" account with Wise which will have its own ACH bank number and customer account number. You can usually do an ACH bank to bank transfer from your US Bank to fund the "virtual" account.

The funds are held by Wise in the currency you choose (e.g., US$)

I thought they were not.

Wise also tell us they do not lend this money out, then proceed to describe how they lend it out.....

https://wise.com/help/articles/2949821/ ... money-safe

- 2lz2p

- Posts: 967

- Joined: Sun Aug 01, 2010 8:08 am

- Location: Pattaya, Thailand (Jomtien)

- Has thanked: 150 times

- Been thanked: 114 times

Re: Transfering Money to Thailand

No, the funds sent through Wise or held by Wise are not covered by Gov't insurance, e.g., FDIC for US.Jun wrote: ↑Sun Jul 02, 2023 5:34 pm

If actually keeping money with Wise, you might want to consider if this is covered by government bank deposit insurance.

I thought they were not.

Wise also tell us they do not lend this money out, then proceed to describe how they lend it out.....

https://wise.com/help/articles/2949821/ ... money-safe

Using the link you provided, and the links provided therein for UK, EU, and US, I did not see any mention of lending money out, quite the contrary, in each they say they do not lend out your money. They do list the various bank/investments where the money is held.

For UK and EU, they do mention having another program, apparently a separate business from their money transfer business, that a person can invest in.

That asset investment business isn't mentioned for US - but they do mention for US that that money can earn interest and if placed in that category, it is FDIC insured up to US$250,000.We do however offer our Assets feature, which is an investment service, in certain countries. Money invested in Assets is held in segregated accounts, separate from Wise’s own funds.

We are not a bank, which means we do not lend out our customers’ money to people or businesses. It also means our money transfer service and Wise account balances where you haven't opted into interest are not subject to FDIC insurance.

If you’ve opted-in to earn interest on your Wise account, you're able to take advantage of FDIC passthrough insurance on your USD balance up to 250,000 USD.

-

Jun

Re: Transfering Money to Thailand

Holding money in a bank is lending money to the bank. The banks then lend it on to others, usually long term.

If they lend the money to a bank that fails, there is some level of risk.

I consider using their money transfer business to be lower risk than keeping a large sum of money permanently in an account there, as your money is at risk for a far shorter period of time with the currency transfer.

-

Jun

Re: Transfering Money to Thailand

Well, here is a comparison of transfer costs using Wise and XE

Key Points:

1 Wise is cheaper, but XE is better than many other providers and may be useful as an emergency back up.

2 In this example, the XE rate is far worse at the weekend.

3 With XE, there was a bank charge for receiving foreign currency. I've never had this with Wise, receiving money in 3 different countries.

The weekend loss for Wise is better than I expect. I could guess that XE increase margins at the weekend as they might find it more difficult to balance the trade, however I have no idea why the Wise figure is better than expected.

Losses are calculated wrt XE mid market quotes.

Key Points:

1 Wise is cheaper, but XE is better than many other providers and may be useful as an emergency back up.

2 In this example, the XE rate is far worse at the weekend.

3 With XE, there was a bank charge for receiving foreign currency. I've never had this with Wise, receiving money in 3 different countries.

The weekend loss for Wise is better than I expect. I could guess that XE increase margins at the weekend as they might find it more difficult to balance the trade, however I have no idea why the Wise figure is better than expected.

Losses are calculated wrt XE mid market quotes.

- Gaybutton

- Posts: 21595

- Joined: Sat Jul 31, 2010 11:21 am

- Location: Thailand

- Has thanked: 2 times

- Been thanked: 1322 times

Re: Transfering Money to Thailand

XE? This is the first time I've ever heard of it. I didn't know there was more than one service doing essentially the same thing as Wise. Until now I thought Wise is the only one. From what you posted it looks to me that we're better off sticking with Wise.

Would there be a good reason to switch from Wise to XE? Would there be a good reason to start with XE rather than Wise?

Are there any other similar money transfer services?

Would there be a good reason to switch from Wise to XE? Would there be a good reason to start with XE rather than Wise?

Are there any other similar money transfer services?